BVIEC’S MONTHLY FUEL DATA – OCTOBER

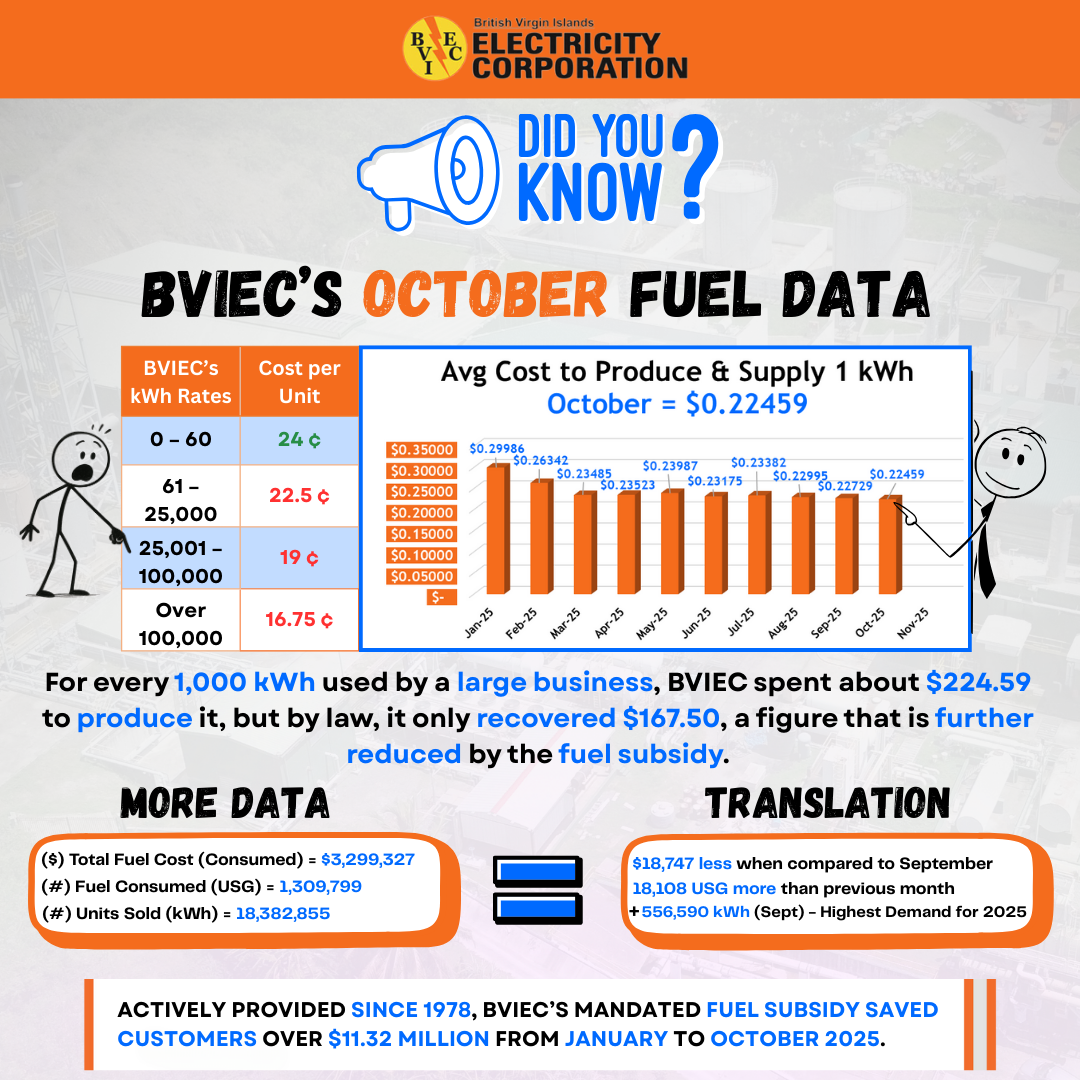

Tortola, British Virgin Islands, November 26, 2025 — October’s fuel data tells a mixed but important story. While global fuel prices dropped and helped reduce BVIEC’s overall production cost to 22.46¢ per kWh, demand for electricity climbed to its highest level in 2025, requiring more fuel and increasing the total fuel surcharge subsidy.

Even with these operational improvements, BVIEC continues to operate within a framework where production costs sit close to, or above, the fixed customer rates established decades ago. The result is that higher demand brings greater pressure, not greater revenue. October, therefore, reinforces what we have seen throughout 2025: BVIEC is generating power more efficiently, yet still absorbing a substantial financial burden to keep electricity affordable for all customers.

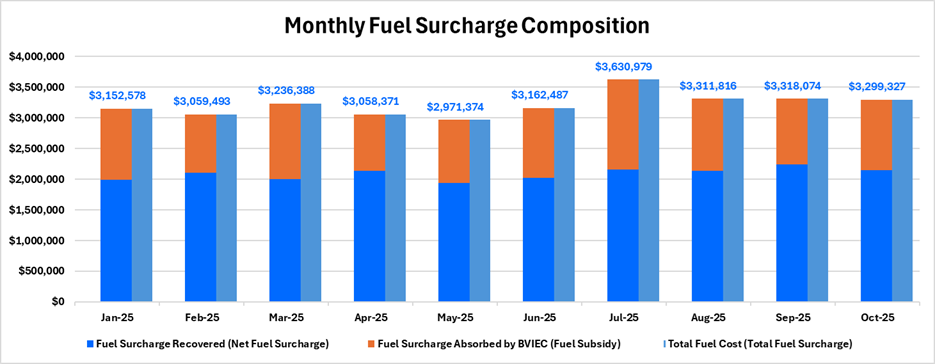

1) Total Fuel Cost – $3,299,327

(September: $3,318,074 → ↓ $18,747)

What it Means:

In October, we spent slightly less on fuel, thanks to a small dip in global fuel prices, amounting to $18,747.

Why it Matters:

Lower spending helps, but with fixed electricity rates that barely cover the cost of production, even small savings don’t relieve the long-term financial pressure on BVIEC.

Relatable Example: A change of $18,747 may sound large, but for BVIEC, it’s like someone saving 50 cents on their weekly grocery bill, noticeable, but far too small to change the overall budget.

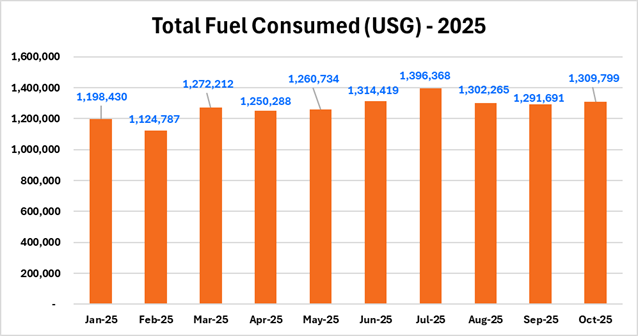

2) Total Fuel Used – 1,309,799 gallons

(September: 1,291,691 → ↑ 18,108 gallons)

What it Means:

We used slightly more fuel in October, but turned it into significantly more electricity, showing good engine performance and demand growth.

Why it Matters:

A small increase in fuel can be beneficial if it results in more electricity for customers, and this month, it did. But higher demand also means a larger subsidy burden under fixed rates.

Relatable Example: The increase alone could fill 1,200 full car tanks (15 gallons each).

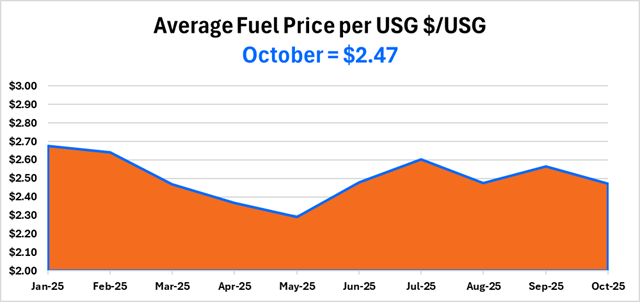

3) Average Fuel Price – $2.46980 per gallon

(September: $2.56553 → ↓ ~10¢ per gallon)

What it Means:

October brought a welcome break in global fuel trends, lowering BVIEC’s fuel purchase price by nearly 10 cents per gallon.

Why it Matters:

Even with this improvement, BVIEC still operates within a system where electricity rates remain fixed, and the Corporation must absorb or subsidise spikes in global fuel prices. A decrease helps temporarily, but it does not eliminate the structural financial pressure caused by the rate system. This month’s savings are meaningful but still small compared to the long-term deficit created when production costs stay close to or above fixed rates.

Relatable Example: This 10¢ drop saved BVIEC around $130,000, enough to fund smaller parts for maintenance, like filters, belts, and lubricants.

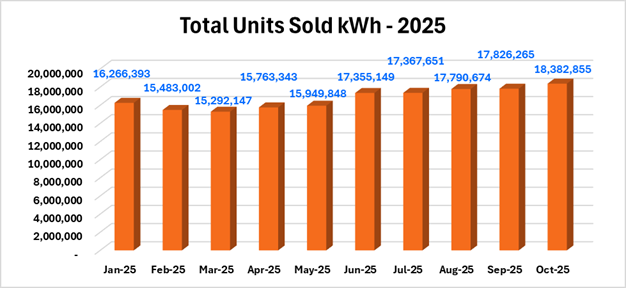

4) Total Units Sold – 18,382,855 kWh

(September: 17,826,265 → ↑ 556,590 kWh)

What it Means:

Electricity usage reached its highest point of 2025, with October surpassing every month before it. More homes, businesses, and industries across the Territory consumed more power.

Why it Matters:

Higher demand often signals economic activity, but under fixed rates, greater electricity usage doesn’t equal more revenue for BVIEC. In fact, the more energy large users consume at lower fixed rates (like 16.75¢/kWh), the more BVIEC’s unrecovered production cost grows.

Relatable Example: Every 1¢ drop per kWh saves BVIEC around $180,000 monthly, showing how valuable efficiency gains are.

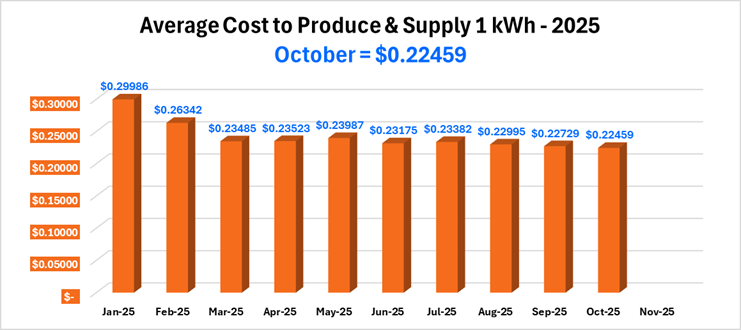

5) Cost to Produce & Supply 1 kWh – 22.46¢

(September: 22.73¢ → ↓ 0.27¢)

What it Means:

Our production cost per unit improved slightly, thanks to better fuel prices and engine efficiency. However, the cost per kWh remains very close to the 24¢ residential rate, and far above the 19¢ and 16.75¢ rates large consumers pay.

Why it Matters:

This cost gap means BVIEC continues to sell electricity below production cost to major consumers, and nearly at cost for smaller users. Each 1,000 kWh used by a high-demand customer widens BVIEC’s financial shortfall even in efficient months.

Relatable Example: For every 1,000 kWh used by a big commercial account, BVIEC still loses around $57 under current rates.

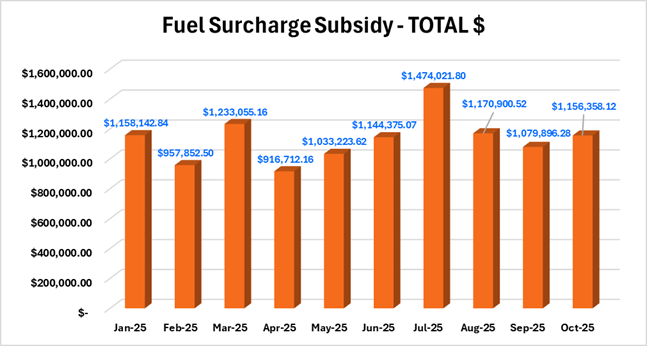

6) Fuel Surcharge Subsidy – $1,156,358.12

(September: $1,079,896.28 → ↑ $76,462)

What it Means:

Because customers consumed more electricity in October, BVIEC absorbed more subsidy dollars, even though fuel was cheaper. Higher usage = higher subsidy.

Why it Matters:

This reveals a long-standing flaw in the current system:

When the Territory uses more electricity, BVIEC must absorb more costs, even if fuel prices fall.

This directly affects BVIEC’s ability to invest in maintenance, resilience upgrades, and future renewable projects.

Relatable Example: October’s subsidy could fund a complete overhaul of one major generator.

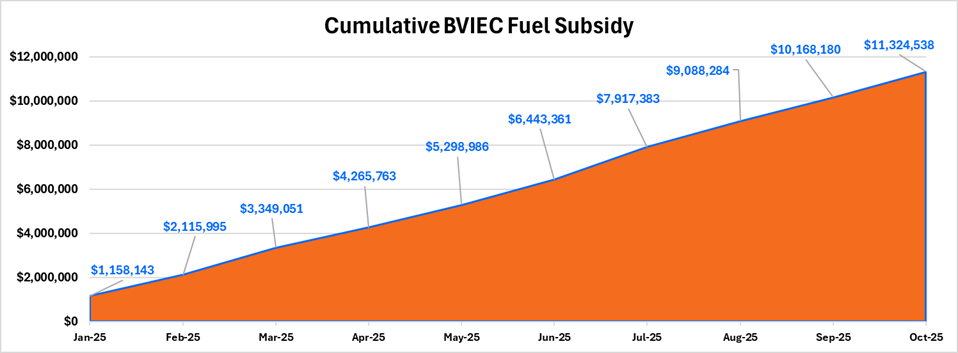

7) Cumulative Subsidy (Jan–Oct) – $11,324,538.08

(September YTD: $10,168,241.81 → ↑ $1.16M)

What it Means:

After 10 months, BVIEC has absorbed over $11.3 million in fuel costs on behalf of customers.

Why it Matters:

This subsidy ensures affordability for customers, but places continued pressure on BVIEC’s financial stability. With infrastructure ageing and demand rising, these funds represent investments BVIEC cannot make in grid modernisation, renewable integration, and maintenance.

Relatable Example: This year’s subsidy equals about $37,000 every single day absorbed by BVIEC on behalf of customers.

Archive

- January 2026

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- January 2025

- December 2024

- July 2024

- February 2024

- June 2023

- December 2022

- August 2022

- January 2022

- November 2021

- October 2021

- May 2021

- January 2021

- December 2020

- June 2020

- March 2020

- October 2019

- August 2019

- November 2018

- July 2018

- August 2017

- May 2017

- January 2017

- October 2016

- September 2016

- August 2016

- March 2015

- December 2014